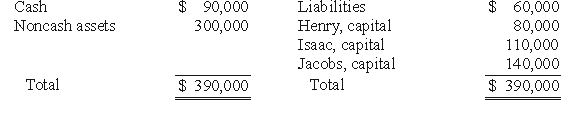

The Henry,Isaac,and Jacobs partnership was about to enter liquidation with the following account balances:

Estimated expenses of liquidation were $5,000.Henry,Isaac,and Jacobs shared profits and losses in a ratio of 2:4:4.

Before liquidating any assets,the partners determined the amount of cash available for safe payments.How should the cash be distributed?

A) in a ratio of 1:2:2 among the partners.

B) $18,333 to Henry and $16,667 to Jacobs.

C) in a ratio of 1:2 between Henry and Jacobs.

D) $15,000 to Henry and $10,000 to Jacobs.

E) $11,364 to Henry and $13,636 to Jacobs.

Correct Answer:

Verified

Q1: The Keaton,Lewis,and Meador partnership had the following

Q2: The following account balances were available for

Q4: The Keaton,Lewis,and Meador partnership had the following

Q5: The Henry,Isaac,and Jacobs partnership was about to

Q6: What is a marshaling of assets?

A)a listing

Q7: The Abrams,Bartle,and Creighton partnership began the process

Q8: The Abrams,Bartle,and Creighton partnership began the process

Q9: A local partnership was considering the possibility

Q10: The Abrams,Bartle,and Creighton partnership began the process

Q11: Which of the following will not result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents