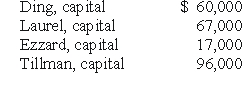

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was insolvent.Capital balances at that time were as follows.Profits and losses were divided on a 4:2:2:2 basis,respectively.

Ding's creditors filed a $25,000 claim against the partnership's assets.At that time,the partnership held assets reported at $360,000 and liabilities of $120,000.

If the assets could be sold for $228,000,what is the minimum amount that Laurel's creditors would have received?

A) $36,000.

B) $0.

C) $2,500.

D) $38,250.

E) $67,250.

Correct Answer:

Verified

Q15: The Henry,Isaac,and Jacobs partnership was about to

Q16: Dancey,Reese,Newman,and Jahn were partners who shared profits

Q17: .A local partnership was in the process

Q18: .The following account balances were available for

Q19: The partnership of Nurr,Cleamons,and Kelly was insolvent,as

Q21: A local partnership has assets of cash

Q22: Which statement below is false?

A)The purpose of

Q23: Which statement below is correct?

A)If a partner

Q24: A local partnership has assets of cash

Q25: Matching

(1. )The schedule of liquidation

(2. )Deficit capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents