REFERENCE: Ref.15_03 Hardin,Sutton,and Williams Has Operated a Local Business as a Partnership

REFERENCE: Ref.15_03

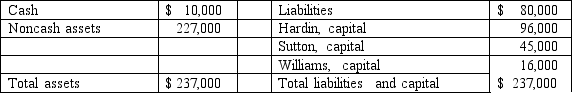

Hardin,Sutton,and Williams has operated a local business as a partnership for several years.All profits and losses have been allocated on a 3:2:1 ratio,respectively.Recently,Williams has undergone personal financial problems,and is insolvent.To satisfy Williams' creditors,the partnership has decided to liquidate.

The following balance sheet has been produced:

During the liquidation process,the following transactions take place:

During the liquidation process,the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid.No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Jones,Marge,and Tate LLP decided to dissolve and liquidate the partnership on September 31,2009.After realization of a portion of the noncash assets,the capital account balances were Jones $50,000;Marge $40,000;and Tate $15,000.Cash of $35,000 and other assets with a carrying amount of $100,000 were on hand.Creditors' claims totaled $30,000.Jones,Marge,and Tate shared net income and losses in a 2:1:1 ratio,respectively.

Prepare a working paper to compute the amount of cash that may be paid to creditors and to partners at this time,assuming that no partner is solvent.

Correct Answer:

Verified

Q29: Xygote, Yen, and Zen were partners who

Q43: Prepare journal entries to record the actual

Q47: Develop a predistribution plan for this partnership,

Q58: Compute safe cash payments after the noncash

Q59: If the noncash assets were sold for

Q60: What are the provisions of the marshaling

Q62: REFERENCE: Ref.15_05

The partners of Donald,Chief & Berry

Q63: Record the journal entry for payment of

Q68: Determine the cash to be retained and

Q69: Record the journal entry for the sale

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents