REFERENCE: Ref.10_02

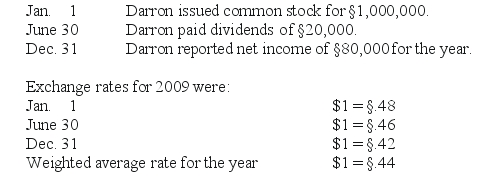

Darron Co.was formed on January 1,2009 as a wholly owned foreign subsidiary of a U.S.corporation.Darron's functional currency was the stickle (§) .The following transactions and events occurred during 2007:

SHAPE \* MERGEFORMAT

-Which accounts are remeasured using current exchange rates?

A) all revenues and expenses.

B) all assets and liabilities.

C) all monetary assets and liabilities.

D) all current assets and liabilities.

E) all noncurrent assets and liabilities.

Correct Answer:

Verified

Q14: REFERENCE: Ref.10_05

A subsidiary of Porter Inc. ,a

Q15: REFERENCE: Ref.10_02

Darron Co.was formed on January 1,2009

Q17: REFERENCE: Ref.10_01

Westmore,Ltd.is a British subsidiary of a

Q17: Which one of the following statements would

Q19: In translating a foreign subsidiary's financial statements,

Q20: REFERENCE: Ref.10_02

Darron Co.was formed on January 1,2009

Q21: REFERENCE: Ref.10_05

A subsidiary of Porter Inc. ,a

Q24: REFERENCE: Ref.10_05

A subsidiary of Porter Inc. ,a

Q28: A net asset balance sheet exposure exists

Q39: A net liability balance sheet exposure exists

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents