REFERENCE: Ref.10_05

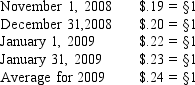

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

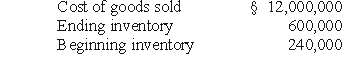

-A U.S.company's foreign subsidiary had the following amounts in stickles (§) in 2009:

The average exchange rate during 2009 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31,2009 was §1 = $.84.Assuming that the foreign country had a highly inflationary economy,at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2009 U.S.dollar income statement?

A) $11,253,600.

B) $11,577,600.

C) $11,649,600.

D) $11,613,600.

E) $11,523,600.

Correct Answer:

Verified

Q3: According to SFAS 52,which method is usually

Q4: REFERENCE: Ref.10_01

Westmore,Ltd.is a British subsidiary of a

Q5: REFERENCE: Ref.10_04

Certain balance sheet accounts of a

Q7: REFERENCE: Ref.10_02

Darron Co.was formed on January 1,2009

Q8: REFERENCE: Ref.10_01

Westmore,Ltd.is a British subsidiary of a

Q9: REFERENCE: Ref.10_02

Darron Co.was formed on January 1,2009

Q10: REFERENCE: Ref.10_04

Certain balance sheet accounts of a

Q11: REFERENCE: Ref.10_05

A subsidiary of Porter Inc. ,a

Q14: What is a company's functional currency?

A) the

Q18: In accounting, the term translation refers to

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents