REFERENCE: Ref.10_05

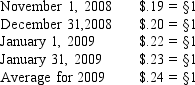

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-When consolidating a foreign subsidiary,which of the following statements is true?

A) Parent reports a cumulative translation adjustment using the equity method.

B) Parent's reports a gain or loss in net income using the equity method.

C) Subsidiary's cumulative translation adjustment is carried forward to the consolidated balance sheet.

D) Subsidiary's income/loss is carried forward to the consolidated balance sheet.

E) All foreign currency gains/losses are eliminated on the consolidated income statement and balance sheet.

Correct Answer:

Verified

Q48: The financial statements for Perez are translated

Q51: REFERENCE: Ref.10_10

Kennedy Company acquired all of the

Q52: REFERENCE: Ref.10_06

The following account balances are available

Q53: REFERENCE: Ref.10_06

The following account balances are available

Q54: REFERENCE: Ref.10_09

Certain balance sheet accounts of a

Q55: REFERENCE: Ref.10_06

The following account balances are available

Q58: REFERENCE: Ref.10_05

A subsidiary of Porter Inc. ,a

Q59: REFERENCE: Ref.10_06

The following account balances are available

Q60: REFERENCE: Ref.10_05

A subsidiary of Porter Inc. ,a

Q61: REFERENCE: Ref.10_11

Quadros Inc. ,a Portugese firm was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents