REFERENCE: Ref.10_08 Perez Company,a Mexican Subsidiary of a U.S.company,sold Equipment Costing 200,000

REFERENCE: Ref.10_08

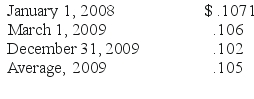

Perez Company,a Mexican subsidiary of a U.S.company,sold equipment costing 200,000 pesos with accumulated depreciation of 75,000 pesos for 140,000 pesos on March 1,2009.The equipment was purchased on January 1,2008,when the exchange rate for the peso was $.11.Relevant exchange rates for the peso are as follows:

SHAPE \* MERGEFORMAT

-The financial statements for Perez are remeasured by its U.S.parent.What amount of gain or loss would be reported in its translated income statement?

A) $1,530.

B) $1,575.

C) $1,465.

D) $1,090.

E) $1,650.

Correct Answer:

Verified

Q43: REFERENCE: Ref.10_10

Kennedy Company acquired all of the

Q44: REFERENCE: Ref.10_10

Kennedy Company acquired all of the

Q45: REFERENCE: Ref.10_05

A subsidiary of Porter Inc. ,a

Q46: REFERENCE: Ref.10_09

Certain balance sheet accounts of a

Q48: REFERENCE: Ref.10_07

The following inventory balances for 2008

Q49: REFERENCE: Ref.10_09

Certain balance sheet accounts of a

Q50: REFERENCE: Ref.10_10

Kennedy Company acquired all of the

Q51: REFERENCE: Ref.10_10

Kennedy Company acquired all of the

Q52: REFERENCE: Ref.10_06

The following account balances are available

Q54: If a subsidiary is operating in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents