REFERENCE: Ref.10_13

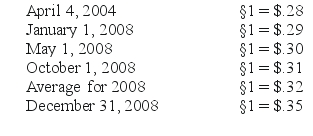

Boerkian Co.started 2008 with two assets: cash of §26,000 (stickles)and land that originally cost §72,000 when acquired on April 4,2004.On May 1,2008,the company rendered services to a customer for §36,000,an amount immediately paid in cash.On October 1,2008,the company incurred an operating expense of §22,000 that was immediately paid.No other transactions occurred during the year.Currency exchange rates were as follows:

SHAPE \* MERGEFORMAT

-Assume (1)that Boerkian was a foreign subsidiary of a U.S.multinational company that used the U.S.dollar as its reporting currency and (2)that the U.S.dollar was the functional currency of the subsidiary.What was the remeasurement gain or loss for 2008?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: REFERENCE: Ref.10_11

Quadros Inc. ,a Portugese firm was

Q81: REFERENCE: Ref.10_12

Ginvold Co.began operating a subsidiary in

Q82: On January 1,2008,Fandu Corp.started a foreign subsidiary.On

Q83: REFERENCE: Ref.10_13

Boerkian Co.started 2008 with two assets:

Q86: On January 1,2008,Veldon Co. ,a U.S.corporation with

Q88: REFERENCE: Ref.10_12

Ginvold Co.began operating a subsidiary in

Q88: Farley Brothers, a U.S. company, had a

Q89: What exchange rate should be used to

Q93: What exchange rate would be used to

Q93: What is the justification for the remeasurement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents