REFERENCE: Ref 01_01

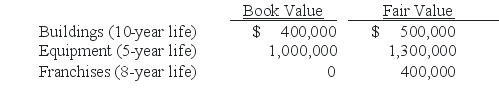

On January 3,2008,Austin Corp.purchased 25% of the voting common stock of Gainsville Co. ,paying $2,500,000.Austin decided to use the equity method to account for this investment.At the time of the investment,Gainsville's total stockholders' equity was $8,000,000.Austin gathered the following information about Gainsville's assets and liabilities:

SHAPE \* MERGEFORMAT

For all other assets and liabilities,book value and fair value were equal.Any excess of cost over fair value was attributed to goodwill,which has not been impaired.

For all other assets and liabilities,book value and fair value were equal.Any excess of cost over fair value was attributed to goodwill,which has not been impaired.

-Club Co.appropriately uses the equity method to account for its investment in Chip Corp.As of the end of 2008,Chip's common stock had suffered a significant decline in fair value,which is expected to be recovered over the next several months.How should Club account for the decline in value?

A) Club should switch to the fair-value method.

B) No accounting because the decline in fair value is temporary.

C) Club should decrease the balance in the investment account to the current value and recognize a loss on the income statement.

D) Club should not record its share of Chip's 2008 earnings until the decline in the fair value of the stock has been recovered.

E) Club should decrease the balance in the investment account to the current value and recognize an unrealized loss on the balance sheet.

Correct Answer:

Verified

Q3: In a situation where the investor exercises

Q4: REFERENCE: Ref.01_02

Starge Inc.owns 30% of the outstanding

Q5: REFERENCE: Ref.01_03

On January 1,2007,Deuce Inc.acquired 15% of

Q6: On January 4,2006,Watts Co.purchased 40,000 shares (40%)of

Q8: Yaro Company owns 30% of the common

Q8: An upstream sale of inventory is a

Q11: On January 1,2007,Jordan Inc.acquired 30% of Nico

Q12: On January 1,2008,Pacer Company paid $1,920,000 for

Q13: Gaw Company owns 15% of the common

Q14: REFERENCE: Ref.01_03

On January 1,2007,Deuce Inc.acquired 15% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents