REFERENCE: Ref.01_14

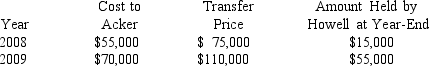

Acker Inc.bought 40% of Howell Co.on January 1,2008 for $576,000.The equity method of accounting was used.The book value and fair value of the net assets of Howell on that date were $1,440,000.Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

-What is the Equity in Howell Income that should be reported by Acker in 2009?

A) $32,000.

B) $41,600.

C) $48,000.

D) $49,600.

E) $50,600.

Correct Answer:

Verified

Q62: What is the amount of the excess

Q74: REFERENCE: Ref.01_14

Acker Inc.bought 40% of Howell Co.on

Q75: REFERENCE: Ref.01_14

Acker Inc.bought 40% of Howell Co.on

Q76: REFERENCE: Ref.01_15

Cayman Inc.bought 30% of Maya Company

Q77: REFERENCE: Ref.01_14

Acker Inc.bought 40% of Howell Co.on

Q79: REFERENCE: Ref.01_15

Cayman Inc.bought 30% of Maya Company

Q80: REFERENCE: Ref.01_11

On January 4,2008,Mason Co.purchased 40,000 shares

Q81: REFERENCE: Ref.01_15

Cayman Inc.bought 30% of Maya Company

Q83: REFERENCE: Ref.01_15

Cayman Inc.bought 30% of Maya Company

Q106: Which types of transactions, exchanges, or events

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents