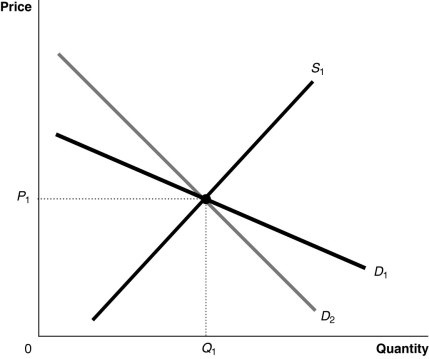

Figure 4-17

-Refer to Figure 4-17.Suppose the market is initially in equilibrium at price P1 and then the government imposes a tax on every unit sold.Which of the following statements best describes the impact of the tax?

A) The consumer will bear a greater share of the tax burden if the demand curve is D1.

B) The consumer's share of the tax burden is the same whether the demand curve is D1 or D2.

C) The consumer will bear a greater share of the tax burden if the demand curve is D2.

D) The consumer will bear the entire burden of the tax if the demand curve is D1 and the producer will bear the entire burden of the tax if the demand curve is D2.

Correct Answer:

Verified

Q142: Government intervention in agriculture began in the

Q152: What is the difference between a price

Q153: What is a black market?

Q159: Price ceilings are illegal in the United

Q162: Suppose the demand curve for a product

Q171: Using a supply and demand graph,illustrate the

Q173: Suppose the demand curve for a product

Q177: When Congress passed a law that imposed

Q328: Figure 4-15 Q339: Figure 4-14 ![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents