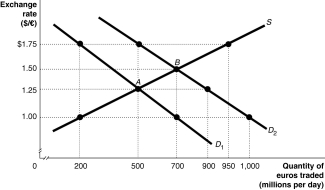

Figure 30-8

-Refer to Figure 30-8. The equilibrium exchange rate is at A, $1.25/euro. Suppose the European Central Bank pegs its currency at $1.00/euro. Speculators expect that the value of the euro will rise and this shifts the demand curve for euro to D2. After the shift,

A) there is a shortage of euro equal to 1,000 million.

B) there is a surplus of euro equal to 400 million.

C) there is a shortage of euro equal to 800 million.

D) there is a surplus of euro equal to 500 million.

Correct Answer:

Verified

Q155: When foreign investors in Thailand began to

Q163: Firms in Thailand that had _ while

Q166: Both countries involved in a pegging of

Q167: China began pegging its currency,the yuan,to the

Q169: One reason purchasing power parity does not

Q171: If the U.S.government removes tariffs it had

Q171: Although the pegged exchange rate between the

Q175: All of the following actions were taken

Q178: China began pegging its currency,the yuan,to the

Q180: Actions taken by investors who sell a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents