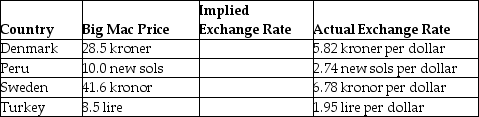

Table 30-1

Source: "The Big Mac Index," Economist, July 11, 2013.

Source: "The Big Mac Index," Economist, July 11, 2013.

-Refer to Table 30-1. Fill in the missing values in the above table. Assume the Big Mac is selling for $4.56 in the United States. Explain whether the U.S. dollar is overvalued or undervalued relative to each of the other currencies and predict what will happen in the future to each exchange rate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q202: The three most important financial centers in

Q203: The "Big Mac Theory of Exchange Rates"

Q205: In 2012,foreign purchases of U.S.corporate stocks and

Q207: The "Big Mac Theory of Exchange Rates"

Q208: Which of the following statements about capital

Q210: European governments removed many restrictions on flows

Q212: Before 1980,most U.S.corporations raised funds

A)in U.S.and foreign

Q213: The three most important international financial centers

Q214: International flows of capital increase both efficiency

Q215: If interest rates in the United States

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents