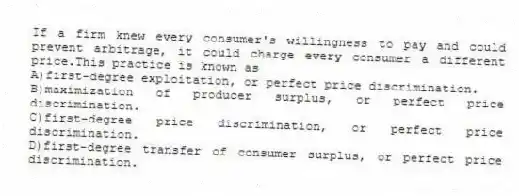

If a firm knew every consumer's willingness to pay and could prevent arbitrage, it could charge every consumer a different price.This practice is known as

A) first-degree exploitation, or perfect price discrimination.

B) maximization of producer surplus, or perfect price discrimination.

C) first-degree price discrimination, or perfect price discrimination.

D) first-degree transfer of consumer surplus, or perfect price discrimination.

Correct Answer:

Verified

Q112: Erin and Deidre, two residents of Ithaca,

Q113: Which of the following products allows the

Q114: In which market structure is it not

Q115: Insurance companies typically charge women lower prices

Q116: Perfect price discrimination is also known as

A)monopoly.

B)first-degree

Q118: Erin and Deidre, two residents in Ithaca,

Q119: A price-discriminating firm charges the highest price

Q120: Bubba's Hula Shack Bar and Bistro has

Q121: Suppose that a price-discriminating producer divides its

Q122: Figure 16-3

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents