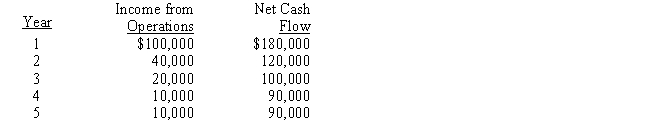

The management of Idaho Corporation is considering the purchase of a new machine costing $430,000.The company's desired rate of return is 10%.The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909,0.826,0.751,0.683,and 0.621,respectively.In addition to the foregoing information,use the following data in determining the acceptability of this investment:  The net present value for this investment is

The net present value for this investment is

A) $16,400

B) $25,200

C) $(99,600)

D) $(126,800)

Correct Answer:

Verified

Q124: Assume in analyzing alternative proposals that Proposal

Q129: Periods in time that experience increasing price

Q136: A company is contemplating investing in a

Q137: A company is contemplating investing in a

Q137: Using the tables above,what is the present

Q140: Brunette Company is contemplating investing in a

Q141: Proposals L and K each cost $600,000,have

Q143: What is capital investment analysis? Why are

Q144: Determine the average rate of return for

Q165: A project has estimated annual net cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents