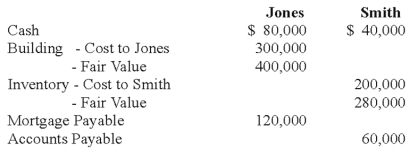

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

-Refer to the above information.What is the balance in each partner's capital account for financial accounting purposes?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q1: Shue,a partner in the Financial Brokers Partnership,has

Q6: The APB partnership agreement specifies that partnership

Q7: The DEF partnership reported net income of

Q8: Which of the following accounts could be

Q9: Which of the following statements best describes

Q12: Which of the following statements best describes

Q13: The JPB partnership reported net income of

Q17: Transferable interest of a partner includes all

Q47: A partner's tax basis in a partnership

Q61: A joint venture may be organized as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents