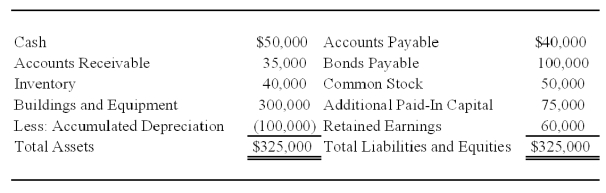

Cinema Company acquired 70 percent of Movie Corporation's shares on December 31,20X5,at underlying book value of $98,000.At that date,the fair value of the noncontrolling interest was equal to 30 percent of the book value of Movie Corporation.Movie's balance sheet on January 1,20X8,contained the following balances:

On January 1,20X8,Movie acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

-Based on the preceding information,the eliminating entry needed in preparing a consolidated balance sheet immediately following the acquisition of shares will include:

A) a credit to NCI in NA of Movie Corp.for $19,375.

B) a credit to Additional Paid-In Capital for $75,000.

C) a debit to Treasury Shares for $30,000.

D) a credit to Investment in Movie stock for $6,125.

Correct Answer:

Verified

Q27: On January 1,20X7,Pisa Company acquired 80 percent

Q28: The elimination entry to prepare the consolidated

Q29: Vision Corporation acquired 75 percent of the

Q30: Cinema Company acquired 70 percent of Movie

Q31: Perfect Corporation acquired 70 percent of Trevor

Q33: On January 1,20X7,Pisa Company acquired 80 percent

Q35: Cinema Company acquired 70 percent of Movie

Q39: Perfect Corporation acquired 70 percent of Trevor

Q42: On January 1,20X9,A Company acquired 85 percent

Q44: X Corporation owns 80 percent of Y

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents