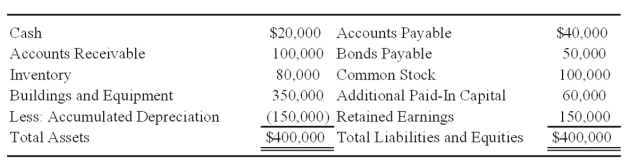

Windsor Corporation acquired 90 percent of Agro Corporation's common shares on January 1,20X6,at underlying book value.At that date,the fair value of the noncontrolling interest was equal to 10 percent of the book value of Agro.Agro Corporation prepared the following balance sheet as of January 1,20X9:

The company is considering a 3-for-1 stock split,a stock dividend of 7,000 shares,or a stock dividend of 2,000 shares on its $5 par value common stock.The current market price per share of Agro stock on January 1,20X9,is $15.

Required:

Give the investment elimination entry required to prepare a consolidated balance sheet at the close of business on January 1,20X9,for each of the alternative transactions under consideration by Agro Corporation.

Correct Answer:

Verified

Alter...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Perfect Corporation acquired 70 percent of Trevor

Q37: The elimination entry to prepare the consolidated

Q39: On January 1,20X7,Pisa Company acquired 80 percent

Q40: Cinema Company acquired 70 percent of Movie

Q41: Connector Corporation invested in an unincorporated joint

Q41: X Corporation owns 80 percent of Y

Q45: Connector Corporation invested in an unincorporated joint

Q47: X Corporation owns 80 percent of Y

Q47: Assume instead that Bricks declared a stock

Q52: Plum Corporation acquired 80 percent of Saucy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents