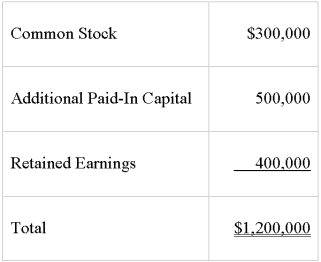

Paco Company acquired 100 percent of the stock of Garland Corp.on December 31,20X8.The stockholder's equity section of Garland's balance sheet at that date is as follows:

Paco financed the acquisition by using $880,000 cash and giving a note payable for $400,000.Book value approximated fair value for all of Garland's assets and liabilities except for buildings which had a fair value $60,000 more than its book value and a remaining useful life of 10 years.Any remaining differential was related to goodwill.Paco has an account payable to Garland in the amount of $30,000.

Required:

1)Present all eliminating entries needed to prepare a consolidated balance sheet immediately following the acquisition.

2)What additional eliminating entry must be prepared at December 31,20X9?

Correct Answer:

Verified

Q30: On January 1,20X8,Patriot Company acquired 100 percent

Q33: On December 31,20X8,Polaris Corporation acquired 100 percent

Q41: Silver Corporation acquired 100 percent of Bronze

Q42: Top Company obtained 100 percent of Bottom

Q43: On December 31,20X9,Thessaly Corporation acquired all of

Q44: Dish Corporation acquired 100 percent of the

Q45: Which of the following is true? When

Q47: Lea Company acquired all of Tenzing Corporation's

Q48: Plant Company acquired all of Sprout Corporation's

Q56: Plant Company acquired all of Sprout Corporation's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents