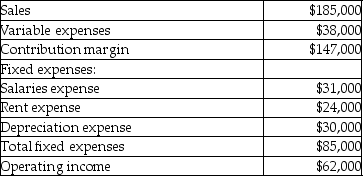

Buster Corporation is evaluating a capital investment project which would require an initial investment of $285,000 to purchase machinery. The annual revenues and expenses generated solely by this project each year during the project's nine year life would be:

The residual value of the machinery at the end of the nine years would be $15,000. The payback period of this potential project in years would be closest to

A) 1.6.

B) 3.1.

C) 3.7.

D) 4.6.

Correct Answer:

Verified

Q40: Which term below is best described as

Q41: Sawyer & Cecil, Computer Consultants, is considering

Q42: Use the information below to answer the

Q43: Use the information below to answer the

Q44: Use the information below to answer the

Q46: Use the information below to answer the

Q47: Use the information below to answer the

Q48: Use the information below to answer the

Q49: Use the information below to answer the

Q50: Rinky Dink Family Fun Centre bought new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents