Use the information below to answer the following question(s) .

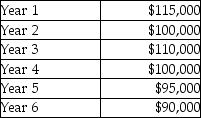

Sommer Corporation is deciding whether to automate one phase of its production process. The equipment has a six-year life and will cost $410,000. Projected net cash inflows from the equipment are as follows:

Sommer Corporation's hurdle rate is 12%. Assume the residual value is zero.

Sommer Corporation's hurdle rate is 12%. Assume the residual value is zero.

-If Sommer Corporation decides to refurbish the equipment at a cost of $50,000 at the end of year 6, it could be used for one more year and would have a $30,000 residual value at the end of year 7. Assume the cash inflow in year 7 is $65,000. The NPV of just the refurbishment is closest to

A) $4,030.

B) $15,820.

C) $17,590.

D) $41,170.

Correct Answer:

Verified

Q140: In computing the IRR of an investment,

Q141: Use the information below to answer the

Q142: Use the information below to answer the

Q143: Use the information below to answer the

Q144: Use the information below to answer the

Q146: Copper Creations is evaluating a project that

Q147: Use the information below to answer the

Q148: Speedy Company has three potential projects from

Q149: Use the information below to answer the

Q150: Use the information below to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents