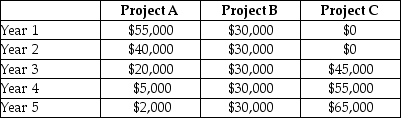

Lion Enterprises Inc. is evaluating 3 investment alternatives. Each alternative requires a cash outflow of $102,000. The cash inflows are summarized below (ignore taxes):

The company has a required rate of return of 9%.

The company has a required rate of return of 9%.

Required:

Evaluate and rank each alternative using net present value (NPV).

Correct Answer:

Verified

Q39: The net present value method is preferable

Q74: The Zero Machine Company is evaluating a

Q187: The Internal Rate of Return and the

Q189: Which of the following capital budgeting models

Q190: When the present value of expected cash

Q191: A company is evaluating a variety of

Q195: The net present value model differs from

Q196: Capital budgeting methods will not work with

Q196: Andrea is considering a capital investment that

Q197: Next Service Centre is considering purchasing a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents