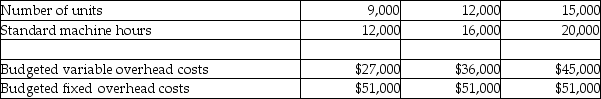

DeNozio Enterprises gathered the following information for the month of July:

Overhead flexible budget:

Gordon actually produced 13,000 units in 16,400 machine hours. Total actual overhead cost of $82,000 consisted of $33,000 variable costs and $49,000 fixed costs. The standard variable and fixed overhead rates are based on a master (static) budget of 12,000 units. Assume the allocation base for fixed overhead costs is the number of units.

Gordon actually produced 13,000 units in 16,400 machine hours. Total actual overhead cost of $82,000 consisted of $33,000 variable costs and $49,000 fixed costs. The standard variable and fixed overhead rates are based on a master (static) budget of 12,000 units. Assume the allocation base for fixed overhead costs is the number of units.

Required:

1. Compute the total manufacturing overhead cost variance.

2. Compute the variable overhead flexible budget variance.

3. Compute the fixed overhead budget variance.

4. Compute the production volume variance.

Correct Answer:

Verified

Q94: Can the variable overhead efficiency variance

a.be computed

Q203: A standard cost income statement shows cost

Q207: If a company recognizes variances at the

Q225: Different management levels in Bates Inc. require

Q227: Cirilla's Weathervane Company manufactures weathervanes. The current

Q228: When a company uses direct materials, the

Q229: Manufacturing cost variances are shown as adjustments

Q232: When recording the use of direct materials

Q233: Use the information below to answer the

Q234: The entry to allocate manufacturing overhead costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents