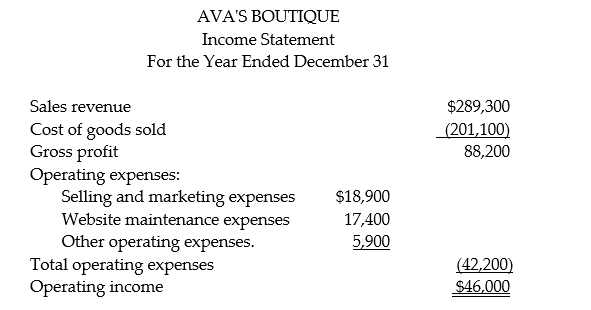

Ava's Boutique is a small e-tail business specializing in the hand crocheted hats for infants and toddlers over the web. The business is owned by a sole proprietor and operated out of her home. Results for last year are as follows:

For internal planning and decision-making purposes, the owner of Ava's Boutique would like to translate the company's income statement into the contribution margin format. Since Ava's Boutique is an e-tailer, all of its cost of goods sold was variable. A large portion of the selling and marketing expenses consisted of freight-out charges ($9,600), which were also variable. Only 10% of the remaining selling and marketing expenses and 25% of the website expenses were variable. Of the other operating expenses, 60% were fixed.

Based on this information, prepare Ava's Boutique's contribution margin income statement for last year.

Correct Answer:

Verified

Calculations for selling and marketing ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q221: Under absorption costing, variable manufacturing costs are

Q237: Under absorption costing, fixed manufacturing costs are

Q244: Variable costing considers fixed manufacturing costs as

Q248: Under variable costing, all nonmanufacturing costs are

Q258: Managers whose bonuses are based on operating

Q305: When a company produces more units than

Q306: Spadina Carriage Company offers guided mini-bus tours

Q308: If inventory has grown, operating income will

Q309: If the number of units produced equals

Q311: Waterfront Tours Company offers guided mini-bus tours

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents