Consider two economies with the following IS curves,denoted 1 and 2:

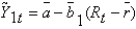

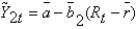

IS1:

IS2:

Given these two curves,the economies are identical except that they respond to interest rate changes differently.Suppose we assume

,b±1 = 1,

,

) If the real interest rate in each economy falls to

,then:

A) Country 1 will move from its long-run equilibrium to 1 percent above its potential and Country 2 will move from its long-run equilibrium to 0.5 percent above its potential.

B) Country 1 will move from its long-run equilibrium to 1 percent above its potential and Country 2 will move from its long-run equilibrium to -0.5 percent below its potential.

C) Country 1 will move from its long-run equilibrium to -1 percent below its potential and Country 2 will move from its long-run equilibrium to 0.5 percent above its potential.

D) Country 1 will move from 0.5 percent below its potential to its long-run equilibrium and Country 2 will move from its long-run equilibrium to 2 percent above its potential.

E) Neither country will move away from its long-run equilibrium.

Correct Answer:

Verified

Q46: In the late 1990s,the United States experienced

Q47: Suppose we assume that initially

Q48: The Life Cycle hypothesis suggests that people

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents