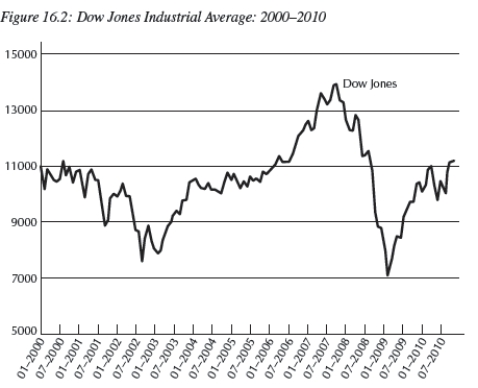

For the following questions refer to Figure 16.2 below.

-Your uncle asks you to explain the price of stock prices based on the financial capital arbitrage equation.He shows you the graph shown in Figure 16.2,which shows the Dow Jones Industrial (DJI) Average for 2000-2010.He asks you to explain the cause in the rise of stock prices for the years 2002-2006.You tell him:

A) "As the DJI rises,there are financial capital gains which drive up stock prices."

B) "The rise in the DJI implies there was an incentive for Congress to increase corporate tax rates,which would have led to falling capital investment.With less capital,stock prices rise."

C) "The rising DJI leads to falling dividend payments which would lead to a decline in physical capital accumulation.With less capital available,the marginal product of capital rises,leading to higher stock prices."

D) "I wasn't paying attention the day we covered this in class."

E) "Rising capital gains,as shown in the figure,have no impact on stock prices."

Correct Answer:

Verified

Q43: The equation Q44: If the real interest rate is,more or Q45: Empirical evidence suggests that _ mutual funds Q46: Over the ten-year period from 1997-2005 real Q49: If the marginal product of capital is Q51: You hear that Ford is likely to Q52: For the following questions refer to Figure Q66: If a stock is just as likely Q72: A financial market is efficient if financial Q80: Tobin's q is:![]()

A) the ratio of stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents