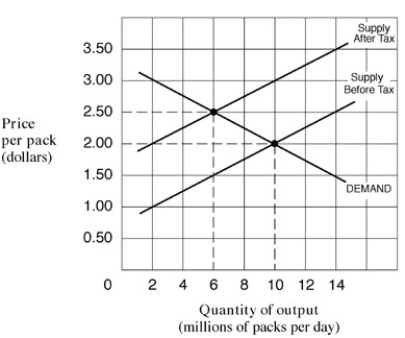

Narrbegin Exhibit 5.4 Supply and demand curves for cigarettes

-As shown in Exhibit 5.4, assume the government places a $1 per pack sales tax on cigarettes. The percentage of the burden of taxation paid by consumers of a pack of cigarettes is:

A) zero.

B) 25 per cent.

C) 50 per cent.

D) 100 per cent.

Correct Answer:

Verified

Q103: Tax incidence depends on:

A) the nature of

Q105: Applying supply and demand analysis, with other

Q106: If the managers of a bus system

Q107: Price elasticity of supply measures the responsiveness

Q109: Narrbegin Exhibit 5.3 Supply and demand curves

Q112: Tax incidence means that:

A) the government increases

Q113: If the elasticity of demand is infinite,

Q247: If a 10 percent price increase causes

Q251: Price elasticity remains constant along a straight-line

Q253: A horizontal demand curve indicates perfectly elastic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents