An investor has $300,000 to invest in two types of investments.Type A pays 5% annually and type B pays 7% annually.To have a well-balanced portfolio, the investor imposes the following conditions.At least one-third of the total portfolio is to be allocated to type A investments and at least one-third of the portfolio is to be allocated to type B investments.What is the optimal amount that should be invested in each investment?

A) $100,000 in type A (5%) , $200,000 in type B (7%)

B) $0 in type A (5%) , $300,000 in type B (7%)

C) $200,000 in type A (5%) , $100,000 in type B (7%)

D) $300,000 in type A (5%) , $0 in type B (7%)

E) $110,000 in type A (5%) , $190,000 in type B (7%)

Correct Answer:

Verified

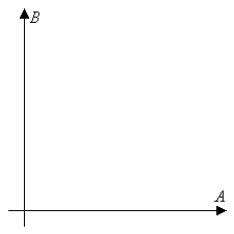

Q73: Sketch the graph of the solution set

Q74: You plan to invest up to $30,000

Q75: A furniture company produces tables and chairs.Each

Q76: Which of the following vertices of the

Q77: An ice cream supplier has two machines

Q79: Which of the following vertices of the

Q80: Find the minimum and maximum values of

Q81: Maximize the object function Q82: The costs to a store two models Q83: A farming cooperative mixes two brands of![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents