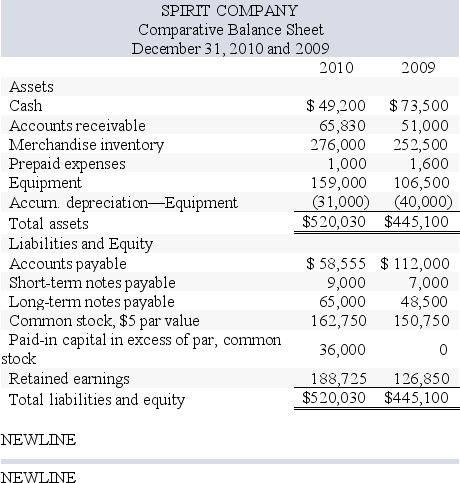

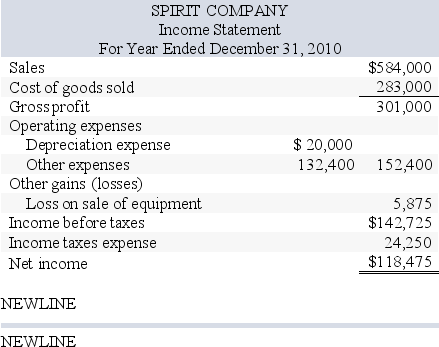

Spirit Company,a merchandiser,recently completed its 2010 calendar year.For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory,and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses.The company's balance sheet and income statement follow:

Additional Information on Year 2010 Transactions

a. The loss on the cash sale of equipment was (details in ) .

b. Sold equipment costing , for a loss of .

c. Purchased equipment costing by paying cash and signing a long-term note payable for the balance.

d. Borrowed cash by signing a short-term note payable.

e. Paid cash to reduce the long-term notes payable.

f. Issued 2,400 shares of common stock for cash per share.

g. Net income and dividends were the only items that affected retained earnings.

What is the net cash flows provided (used) by investing activities?

A) ($23,375)

B) $23,375

C) $46,500

D) ($35,000)

E) $35,000

Correct Answer:

Verified

Q100: Given the following information,determine the amount

Q101: Wessen Company reports net income of $180,000

Q103: Spirit Company,a merchandiser,recently completed the 2010

Q104: The accounting records of Miller Company

Q106: When the operating activities section of the

Q108: Walker Company reports net income of $420,000

Q109: A company had cost of goods

Q110: Net income of Lucky Company was $52,000.The

Q110: Spirit Company,a merchandiser,recently completed its 2010

Q115: When analyzing the changes on a spreadsheet

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents