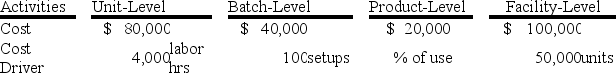

Roadmaster Tires produces a variety of auto and truck tires at its Indianapolis manufacturing plant.The plant is highly automated and uses an activity-based costing system to allocate overhead costs to its various product lines.The costs and cost drivers associated with four activity cost pools are given below:

Production of 1,000 units of a small tractor tire required 200 labor hours and two setups and consumed 10% of the product sustaining activities.

Production of 1,000 units of a small tractor tire required 200 labor hours and two setups and consumed 10% of the product sustaining activities.

Required:

1)Instead of using ABC,suppose the company had used labor hours as a company-wide allocation base.How much total overhead would have been allocated to the tractor tire?

2)How much total overhead cost will be allocated to the tire under activity-based costing?

3)What price will be quoted if the product is priced at 25% above cost? Compute the price under both the direct labor hours approach and under activity-based costing.The direct manufacturing costs consist of direct material of $20 and direct labor of $30.

4)What implications does ABC have on a company that bids on contracts using the costing approach described in Requirement 3?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q144: Décor Carpets incurs a variety of costs

Q145: Ballantine Company manufactures two products.Currently,the company

Q146: Playtime Electronics produces two kinds of electronic

Q147: Gavin Company has asked its management accountant

Q148: Sweetheart Brands packages single-sized servings of

Q149: ABX Company produces two types of

Q150: A number of quality-related costs are provided

Q151: Supply Depot produces a variety of office

Q152: Select from the list provided the term

Q154: Select from the list provided the term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents