Ballantine Company Manufactures Two Products Because the Industrial Product Is Twice as Profitable as the System

Ballantine Company manufactures two products.Currently,the company uses a traditional costing system assigning overhead based on direct labor hours.The Industrial product is more complex to produce,requiring two hours of direct labor time per unit,compared to one hour of direct labor time for the Consumer product.Given the company's total overhead costs of $720,000 and production of 1,000 Industrials and 8,000 Consumers,this results in an overhead allocation rate of $72 per direct labor hour.The following unit data are provided:

Because the Industrial product is twice as profitable as the Consumer model,the sales manager wants to reduce or eliminate production of the Consumer product and devote as much capacity as possible to the Industrial product.

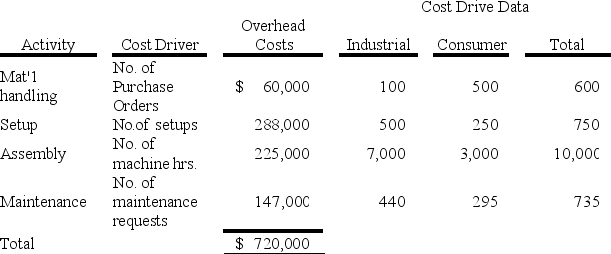

You are worried that the current cost accounting system may be providing inaccurate results and would like to implement an ABC system.Assume that the company's overhead costs were traced to four major activities.The amount of overhead costs traceable to each activity for the current year is provided below:

Required:

Required:

1)Compute the four activity rates that will be used to assign overhead to the products under activity-based costing:

2)Compute the amount of overhead cost which should be assigned to Industrials and Consumers under activity-based costing.Also compute the overhead cost per unit for each product.

3)Compute the total cost to manufacture one unit of each product if activity-based costing is used.

4)Respond to the sales manager's recommendation that capacity be diverted from Consumers to Industrials.

Correct Answer:

Verified

\[\begin{array} { l l ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q140: An increase in prevention costs will often

Q141: Perez Company manufactures two products.Making Product A

Q142: Select the term from the list provided

Q143: Costs may be classified in a

Q144: Décor Carpets incurs a variety of costs

Q146: Playtime Electronics produces two kinds of electronic

Q147: Gavin Company has asked its management accountant

Q148: Sweetheart Brands packages single-sized servings of

Q149: ABX Company produces two types of

Q150: A number of quality-related costs are provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents