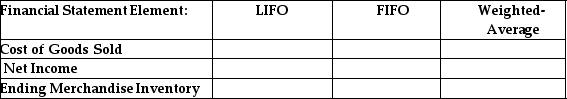

Complete the following table,which compares the effects of LIFO,FIFO and weighted-average inventory costing methods on the financial statements in periods of declining inventory costs.The answer should be lowest,highest,or middle.

Correct Answer:

Verified

Q84: Which of the following inventory valuation methods

Q88: During a period of declining inventory costs,which

Q93: When inventory costs are declining,which of the

Q100: For inventories,market value generally means the current

Q101: Best Deals,Inc.has 10 units in ending merchandise

Q103: Which of the following remains the same

Q105: When using the FIFO inventory costing method,ending

Q111: When using the LIFO inventory costing method,ending

Q112: Which of the following assets must be

Q120: When inventory costs are declining,which of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents