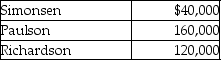

Simonsen,Paulson,and Richardson are partners in a firm with the following capital account balances:

The profit-and-loss-sharing ratio among Simonsen,Paulson,and Richardson is 1:3:2,in the order given.Paulson is retiring from the partnership on December 31,2017.Paulson is paid $230,000 cash in full compensation for her capital account balance.Which of the following is true of the journal entry prepared at the time of retirement?

A) Debit Paulson's capital account by $230,000.

B) Debit Richardson's capital account by $35,000.

C) Debit Simonsen's capital account by $23,333.

D) Debit Income Summary by $70,000.

Correct Answer:

Verified

Q122: Marshall retires from the partnership of Marshall,Mark,and

Q125: Lauren and Elizabeth are partners.Lauren has a

Q126: Simonsen,Paulson,and Richardson are partners in a firm

Q127: Simonsen,Paulson,and Richardson are partners in a firm

Q128: When a partner dies,the partnership ceases to

Q133: When a partner withdraws his or her

Q134: If a withdrawing partner receives assets worth

Q134: Gary,Peter,and Chris own a firm as partners.Gary

Q138: Whenever a partner mix in a partnership

Q149: Mary,Ann,and Beth are partners.Their capital balances are,$23,000;

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents