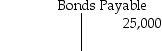

On January 1,2017,Killion Sales issued $25,000 in bonds for $15,700.These are six-year bonds with a stated interest rate of 13% that pay semiannual interest.Killion Sales uses the straight-line method to amortize the Bond Discount.Immediately after the issue of the bonds,the ledger balances appeared as follows:

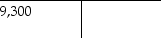

Discount on Bonds Payable

After the first interest payment on June 30,2017,what is the balance of Discount on Bonds Payable? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

A) debit of $8,525

B) debit of $9,300

C) debit of $10,075

D) credit of $775

Correct Answer:

Verified

Q111: Which of the following is true of

Q112: On January 1,2017,Streuly Sales issued $28,000 in

Q113: Blandings Glassware Company issues $1,171,000 of 12%,10-year

Q114: The balance in the Bonds Payable account

Q115: On January 1,2017,Walker Sales issued $19,000 in

Q117: Salt Lake Glassware Company issues $1,022,000 of

Q119: Case Wines Company issues $811,000 of 11%,10-year

Q132: The amortization of bond premium increases interest

Q137: Premium on Bonds Payable is additional Interest

Q147: An alternative to calling the bonds is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents