Middlebrook Financial Services,Inc.invested $24,000 to acquire 3,750 shares of Mitt Investments,Inc.on March 15,2013.This investment represents less than 20% of the investee's voting stock.On May 7,2017,Middlebrook Financial Services,Inc.sells 2,500 shares for $17,250.Which of the following will be the correct journal entry for the May 1,2017 transaction? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

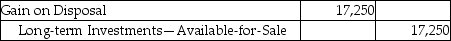

A)

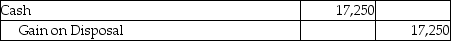

B)

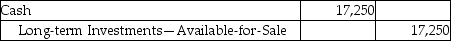

C)

D)

Correct Answer:

Verified

Q78: Gain on Disposal of a trading investment

Q79: Which of the following is true of

Q80: At the beginning of the year,Joan Steel,Inc.purchased

Q82: Kelly Financial Services,Inc.invested $33,000 to acquire 7,250

Q84: Elite Services,Inc.pays $1,950,000 to acquire 38% of

Q85: Glitter Services,Inc.pays $1,350,000 to acquire 35% of

Q86: Pan Services,Inc.owns 35% of voting stock of

Q87: The Long-term Investments account is debited for

Q113: A _ ownership in the investee's voting

Q116: Investments accounted for by the equity method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents