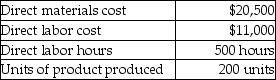

Irene Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,the company estimated total manufacturing overhead costs at $1,000,000 and total direct labor costs at $820,000.In June,Job 711 was completed.The details of Job 711 are shown below.

How much was the cost per unit of finished product? (Round any percentages to two decimal places and your final answer to the nearest cent. )

A) $157.50

B) $202.60

C) $169.60

D) $224.60

Correct Answer:

Verified

Q62: Midtown,Inc.uses a predetermined overhead allocation rate of

Q65: Doric Agricultural Corporation uses a predetermined overhead

Q66: Olympia Manufacturing uses a predetermined overhead allocation

Q67: Halcyon,Inc.completed Job 10B last month.The cost details

Q70: Jezebel,Inc.completed Job 12 and several other jobs

Q71: Jeremy Corporation estimated manufacturing overhead costs for

Q71: Haddows,Inc.completed Job GH6 last month.The cost details

Q73: Gill Manufacturing uses a predetermined overhead allocation

Q74: Iglesias,Inc.completed Job 12 on November 30.The details

Q98: The journal entry to record allocation of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents