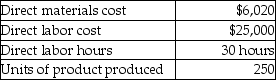

Jordan Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,it estimated the manufacturing overhead rate to be 30% times the direct labor cost.In the month of June,Jordan completed Job 13C,and its details are as follows:

What is the cost per unit of finished product of Job 13C? (Round your answer to the nearest cent. )

A) $154.08

B) $131.30

C) $124.12

D) $130.00

Correct Answer:

Verified

Q62: Midtown,Inc.uses a predetermined overhead allocation rate of

Q67: Manufacturing overhead costs are allocated to the

Q72: Gardner Machine Shop estimates manufacturing overhead costs

Q73: Gill Manufacturing uses a predetermined overhead allocation

Q74: Iglesias,Inc.completed Job 12 on November 30.The details

Q76: Happy Clicks,Inc.uses a predetermined overhead allocation rate

Q77: Manufacturing overhead is allocated by debiting the

Q78: Archangel Manufacturing calculated a predetermined overhead allocation

Q81: The Quadrangle Fabrication Plant suffered a fire

Q82: Clinton Manufacturing uses a predetermined overhead allocation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents