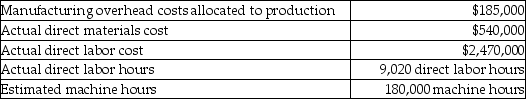

Q-dot Manufacturing uses a predetermined overhead allocation rate based on direct labor hours.It has provided the following information for the year:

Based on the above information,calculate Q-dot's predetermined overhead allocation rate.(Round your answer to two decimal places. )

A) $1.03 per machine hour

B) 7.49% of direct labor cost

C) 34.26% of direct materials cost

D) $20.51 per direct labor hour

Correct Answer:

Verified

Q82: Altima,Inc.finished Job A40 on the last working

Q85: On January 1,Biden,Inc.'s Work-in-Process Inventory account had

Q86: Melinda,Inc.estimates manufacturing overhead costs for the coming

Q90: Forsyth,Inc.uses estimated direct labor hours of 240,000

Q96: Felton Quality Productions uses a predetermined overhead

Q97: Ivade,Inc.uses a predetermined overhead allocation rate of

Q99: At the beginning of the year,Conway Manufacturing

Q101: The cost of goods manufactured is recorded

Q107: The cost of goods manufactured is recorded

Q113: When a job is completed,the total cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents