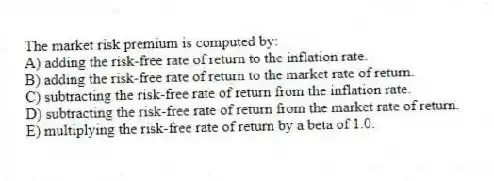

The market risk premium is computed by:

A) adding the risk-free rate of return to the inflation rate.

B) adding the risk-free rate of return to the market rate of return.

C) subtracting the risk-free rate of return from the inflation rate.

D) subtracting the risk-free rate of return from the market rate of return.

E) multiplying the risk-free rate of return by a beta of 1.0.

Correct Answer:

Verified

Q48: Which one of the following is represented

Q49: Which one of the following is the

Q50: Standard deviation measures which type of risk?

A)

Q51: Which one of the following will be

Q52: A stock with an actual return that

Q54: The common stock of Manchester & Moore

Q55: Assume the market rate of return is

Q56: Which one of the following should earn

Q57: The reward-to-risk ratio for Stock A is

Q58: You recently purchased a stock that is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents