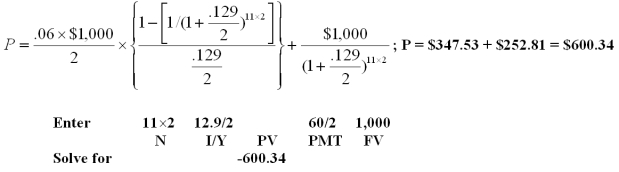

Part of the Rock,Inc.has a 6% coupon bond that matures in 11 years.The bond pays interest semiannually.What is the market price of a $1,000 face value bond if the yield to maturity is 12.9%?

A) $434.59

B) $580.86

C) $600.34

D) $605.92

E) $947.87

Correct Answer:

Verified

Q2: The newly issued bonds of the Cain

Q4: The principal amount of a bond that

Q6: A bond with a 6% coupon that

Q11: A bond that makes no coupon payments

Q15: The stated interest payment,in dollars,made on a

Q23: Your firm offers a 10-year,zero coupon bond.The

Q24: The bonds issued by Manson & Son

Q24: A zero coupon bond:

A) is sold at

Q26: Otto Enterprises has a 15-year bond issue

Q29: The Fisher Effect primarily emphasizes the effects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents