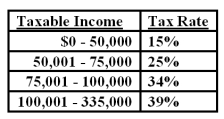

Given the tax rates as shown,what is the average tax rate for a firm with taxable income of $126,500?

A) 21.38%

B) 23.88%

C) 25.76%

D) 34.64%

E) 39.00%

Correct Answer:

Verified

Q41: Free cash flow is:

A)without cost to the

Q42: One of the reasons why cash flow

Q43: Total assets are $1000,fixed assets are $700,long-term

Q44: Martha's Enterprises spent $2,500 to purchase equipment

Q45: Cash flow to stockholders is defined as:

A)interest

Q47: Under GAAP/IFRS,a firm's assets are reported at:

A)market

Q49: Which of the following statements concerning the

Q50: The cash flow of the firm must

Q56: Brad's Company has equipment with a book

Q73: At the beginning of the year,a firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents