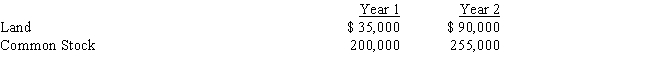

Tracy Company reported the following information at the end of Year 1 and Year 2:

An analysis of the company's records indicated that there were no cash flow effects resulting from the changes in the two accounts presented above.How should Tracy report the changes in these accounts on a statement of cash flows?

A) The company should report $55,000 for the acquisition of land as an investing activity and $55,000 for the issuance of stock as a financing activity.

B) The company should report $55,000 as a noncash investing and financing activity for the acquisition of land by issuing common stock.

C) The company should report the issuance of common stock to acquire land in the financing activity section with a net cash flow effect of zero.

D) The company should report the acquisition of land by issuing common stock in the investing activity section with a net cash flow effect of zero.

Correct Answer:

Verified

Q56: The primary purpose of the statement of

Q57: The balance sheet accounts affected by operating

Q58: The statement of cash flows does not

Q59: As transactions increase in number and complexity,

Q60: Which of the following is included in

Q62: If a company has both an inflow

Q63: Which method of preparing the operating activities

Q64: Which of the following is used in

Q65: Smith and Company reported net income for

Q66: Which one of the following items is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents