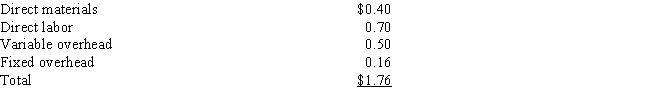

Elite Inc.has many divisions that are evaluated on the basis of return on investment (ROI) .One division, Beta, makes boxes.A second division, Lambda, makes chocolates and needs 90,000 boxes per year.Beta incurs the following costs for one box:

Beta has the capacity to make 720,000 boxes per year.Lambda currently buys its boxes from an outside supplier for $2.00 each (the same price that Beta receives) .

-Assume that Elite Inc.mandates that any transfers take place at full manufacturing cost. What would be the transfer price if Beta transferred boxes to Lambda?

A) $1.35

B) $1.76

C) $1.00

D) The transfer price cannot be determined from the information given.

E) $0.90

Correct Answer:

Verified

Q103: If the selling division is operating at

Q104: Planet Company had the following historical

Q105: The strategic management system that translates an

Q106: Full Serve Inc.has a number of divisions.One

Q107: Division A produces a component and wants

Q109: Quinn Inc.has a number of divisions.One division,

Q110: The Balanced Scorecard perspective that describes the

Q111: Full Serve Inc.has a number of divisions.One

Q112: Quinn Inc.has a number of divisions.One division,

Q113: Elite Inc.has many divisions that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents