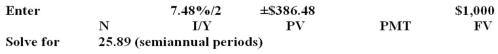

A zero coupon bond has a yield to maturity of 7.48 percent,semiannual compounding,a $1,000 face value,and a market price of $386.48.How many years is it until this bond matures?

A) 11.58 years

B) 13.18 years

C) 12.95 years

D) 23.16 years

E) 25.89 years

Correct Answer:

Verified

Q40: What does the spread between the bid

Q41: A Treasury bond matures in 17 years,pays

Q42: River Tours has 7.5 percent coupon bonds

Q43: Webster's has a 12-year bond issue outstanding

Q44: Antonio's offers a 10-year bond that has

Q46: A General Co.bond has a coupon rate

Q47: A 20-year zero coupon bond has a

Q48: Gugenheim offers a 15-year coupon bond with

Q49: Autos and More offers a zero coupon

Q50: The bonds offered by Leo's Pumps are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents