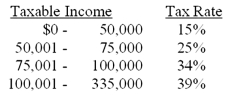

The tax rates are as shown.Your firm currently has taxable income of $74,000.How much additional tax will the firm owe if it increases its taxable income by $25,000?

A) $9,700

B) $8,500

C) $6,250

D) $7,560

E) $8,410

Correct Answer:

Verified

Q44: At the beginning of the year,a firm

Q45: Total assets are $1,500,fixed assets are $1,100,long-term

Q46: Identify three cash flows that occur between

Q47: A firm has beginning retained earnings of

Q48: Given the tax rates as shown,what is

Q50: Martha's Enterprises spent $2,400 to purchase equipment

Q51: A firm has total equity of $1,890,net

Q52: Pete's Boats has beginning long-term debt of

Q53: Teddy's Pillows had beginning net fixed assets

Q54: Identify three items that are included on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents