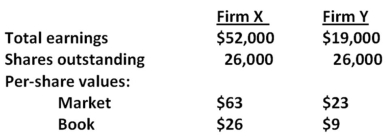

Consider the following premerger information about Firm X and Firm Y:

Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

A) $1,274,000

B) $1,316,000

C) $1,352,000

D) $1,422,000

E) $1,427,000

Correct Answer:

Verified

Q62: Alpha is planning on merging with Beta.Alpha

Q70: Outdoor Living has agreed to be acquired

Q71: Merchantile Exchange is being acquired by National

Q73: Firm B is being acquired by Firm

Q76: Hanover Tires is being acquired by Better

Q76: Silver Enterprises has acquired All Gold Mining

Q80: Sleep Tight is acquiring Restful Inns for

Q81: Defensive merger tactics are designed to thwart

Q83: The shareholders of Jolie Company have voted

Q86: Penn Corp.is analyzing the possible acquisition of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents