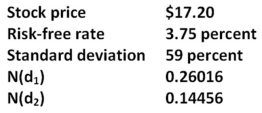

What is the value of a 6-month call with a strike price of $25 given the Black-Scholes option pricing model and the following information?

A) $0

B) $0.93

C) $1.06

D) $1.85

E) $2.14

Correct Answer:

Verified

Q29: The value of the risky debt of

Q43: J&N,Inc.stock has a current market price of

Q57: A purely financial merger:

A)increases the risk that

Q60: What is the value of a 3-month

Q61: Identify the five variables that affect the

Q63: A stock is currently selling for $36

Q64: Explain how an increase in T-bill rates

Q75: A stock is currently selling for $56

Q76: A put option that expires in eight

Q77: The current market value of the assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents