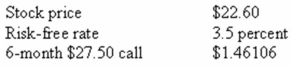

What is the value of a 6-month put with a strike price of $27.25 given the Black-Scholes option pricing model and the following information?

A) $4.71

B) $4.88

C) $5.24

D) $5.64

E) $6.62

Correct Answer:

Verified

Q65: The current market value of the assets

Q66: The delta of a call option on

Q67: Explain how option pricing theory can be

Q69: You need $12,000 in 6 years.How much

Q70: Give an example of a protective put

Q72: What is the value of a 3-month

Q72: The delta of a call option on

Q73: The current market value of the assets

Q78: Explain why financial mergers tend to benefit

Q79: Explain why the equity ownership of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents