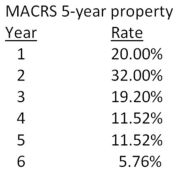

Crafter's Supply purchased some fixed assets 2 years ago at a cost of $38,700.It no longer needs these assets so it is going to sell them today for $25,000.The assets are classified as 5-year property for MACRS.What is the net cash flow from this sale if the firm's tax rate is 30 percent?

A) $13,122.20

B) $18,576.00

C) $20,843.68

D) $23,072.80

E) $25,211.09

Correct Answer:

Verified

Q67: A project will produce an operating cash

Q68: Bruno's Lunch Counter is expanding and expects

Q69: A proposed expansion project is expected to

Q71: You own some equipment that you purchased

Q72: You just purchased some equipment that is

Q73: Peterborough Trucking just purchased some fixed assets

Q77: You are working on a bid to

Q77: Edward's Manufactured Homes purchased some machinery 2

Q79: Automated Manufacturers uses high-tech equipment to produce

Q80: The Buck Store is considering a project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents