Multiple Choice

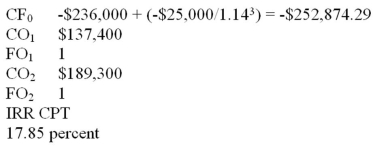

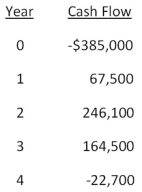

-Sheakley Industries is considering expanding its current line of business and has developed the following expected cash flows for the project.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 13.4 percent? Why or why not?

A) Yes;The MIRR is 6.50 percent.

B) No;The MIRR is 8.67 percent.

C) Yes;The MIRR is 8.23 percent.

D) No;The MIRR is 6.50 percent.

E) No;The MIRR is 7.59 percent.

Correct Answer:

Verified

Related Questions

Q41: Mutually exclusive projects are best defined as

Q48: Which two methods of project analysis were

Q54: Which one of the following statements would